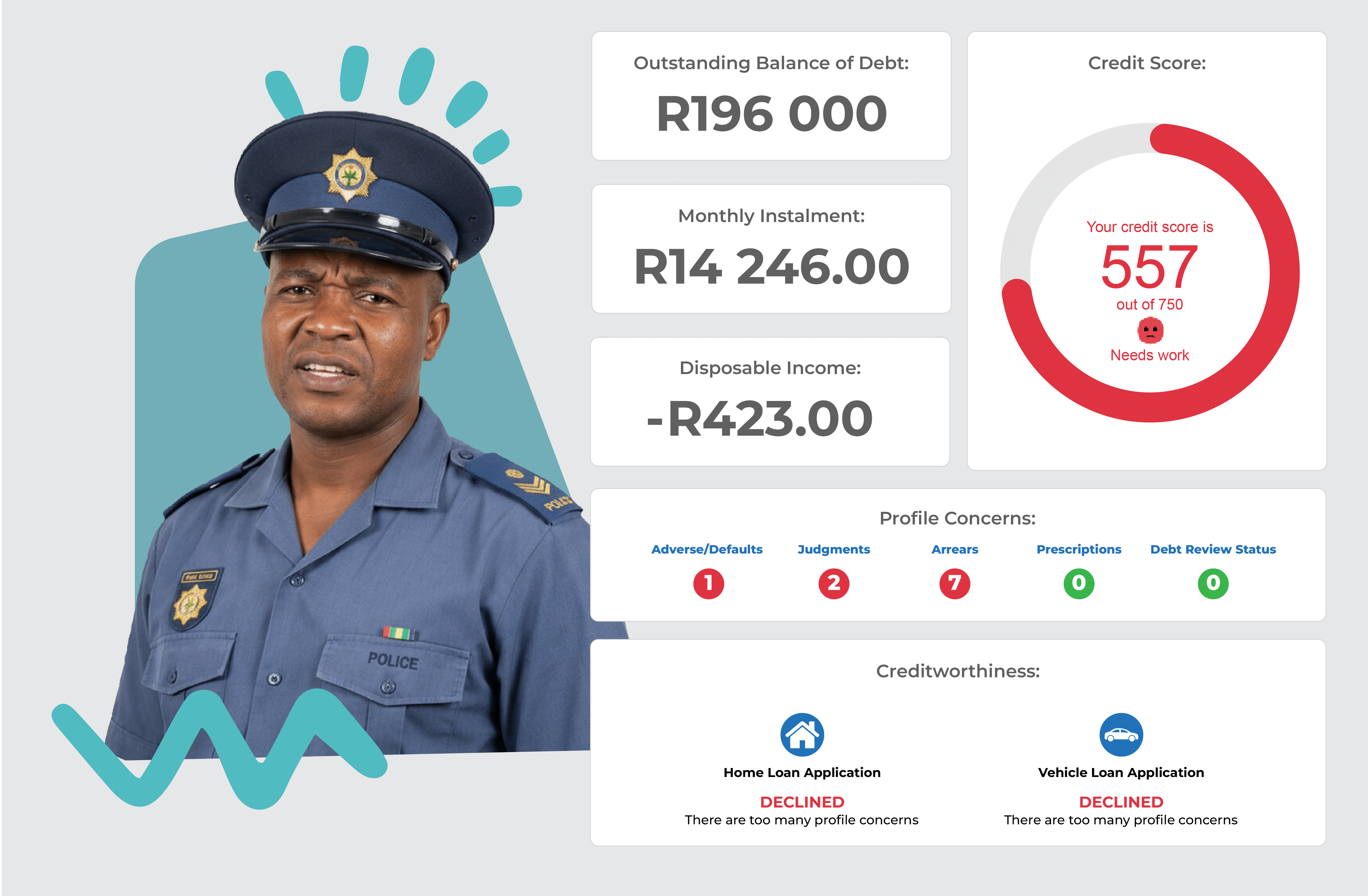

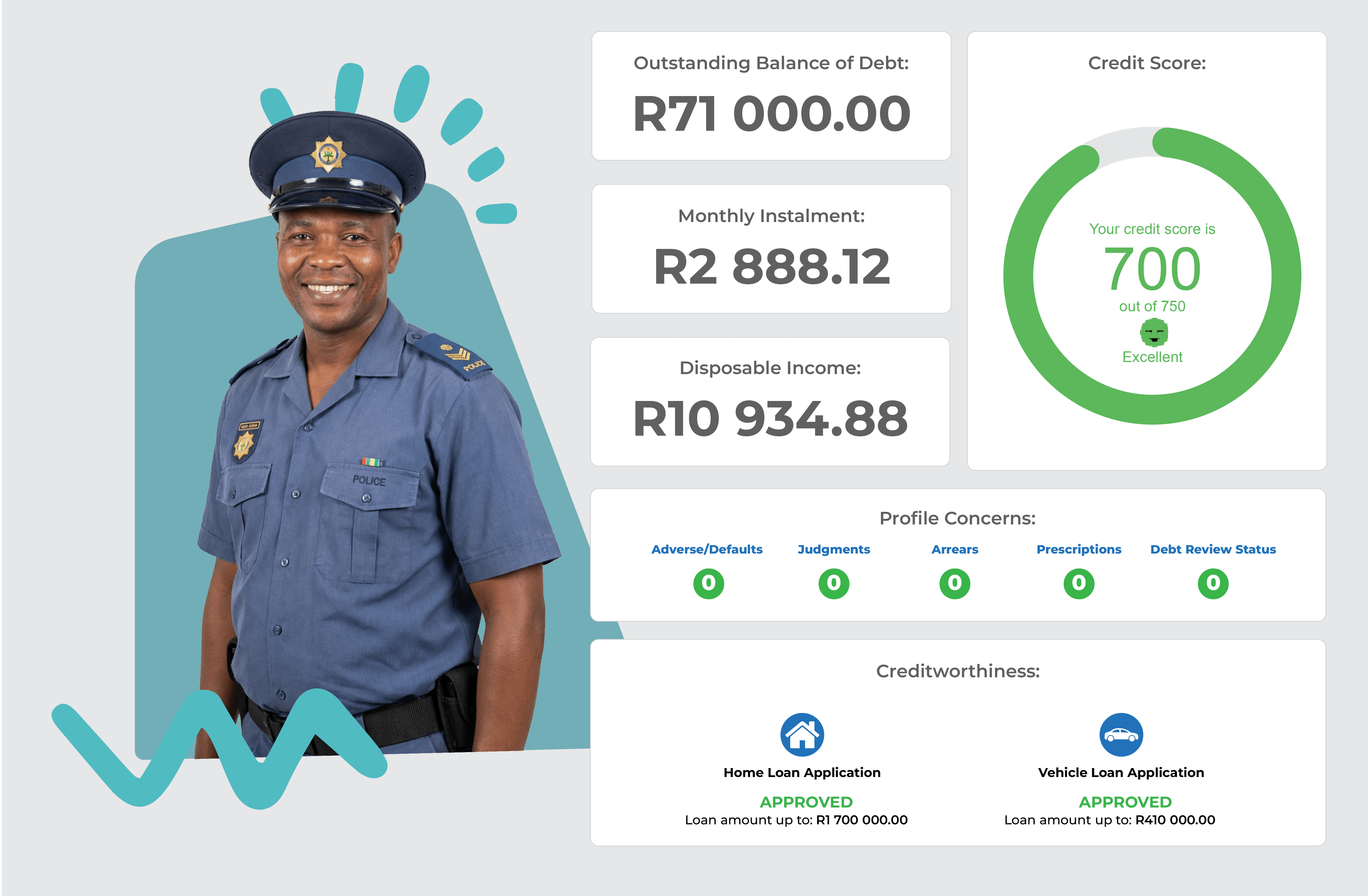

Over-indebted and falling behind? Welltec helps everyday South Africans reset, negotiate, and rebuild — leading to real monthly relief and lasting financial stability.

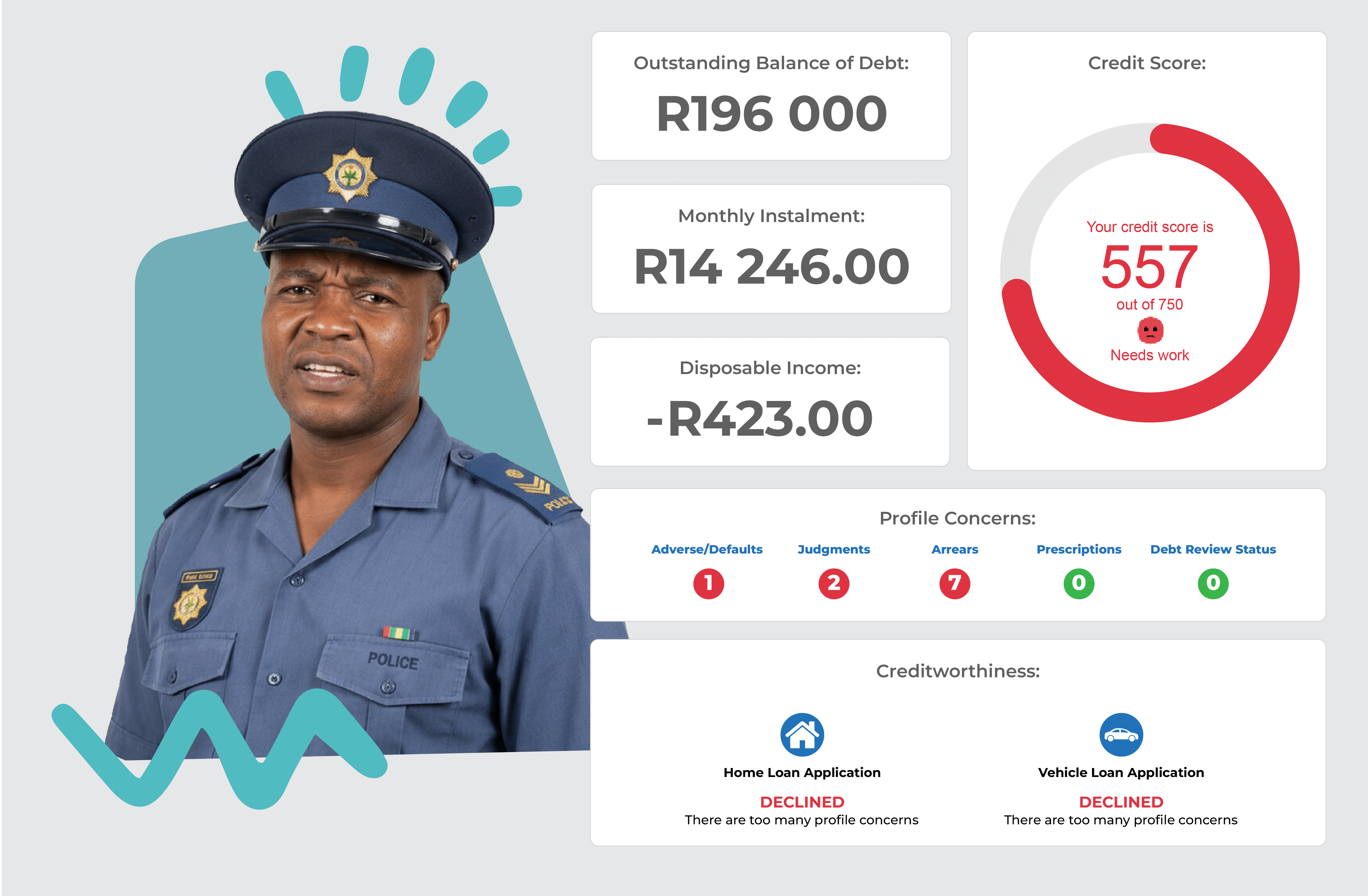

Over-indebted

Over-indebted

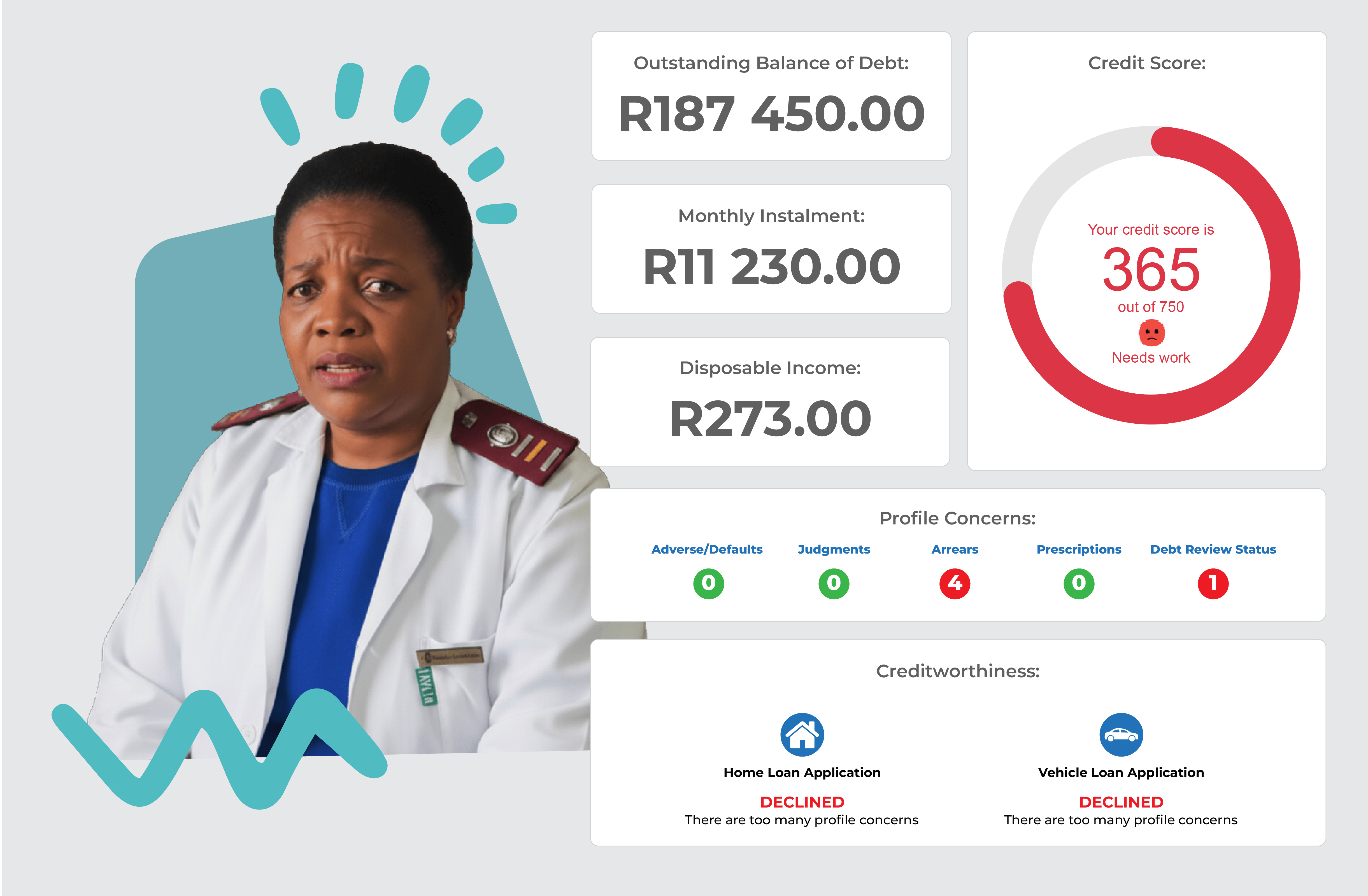

Behind on payments

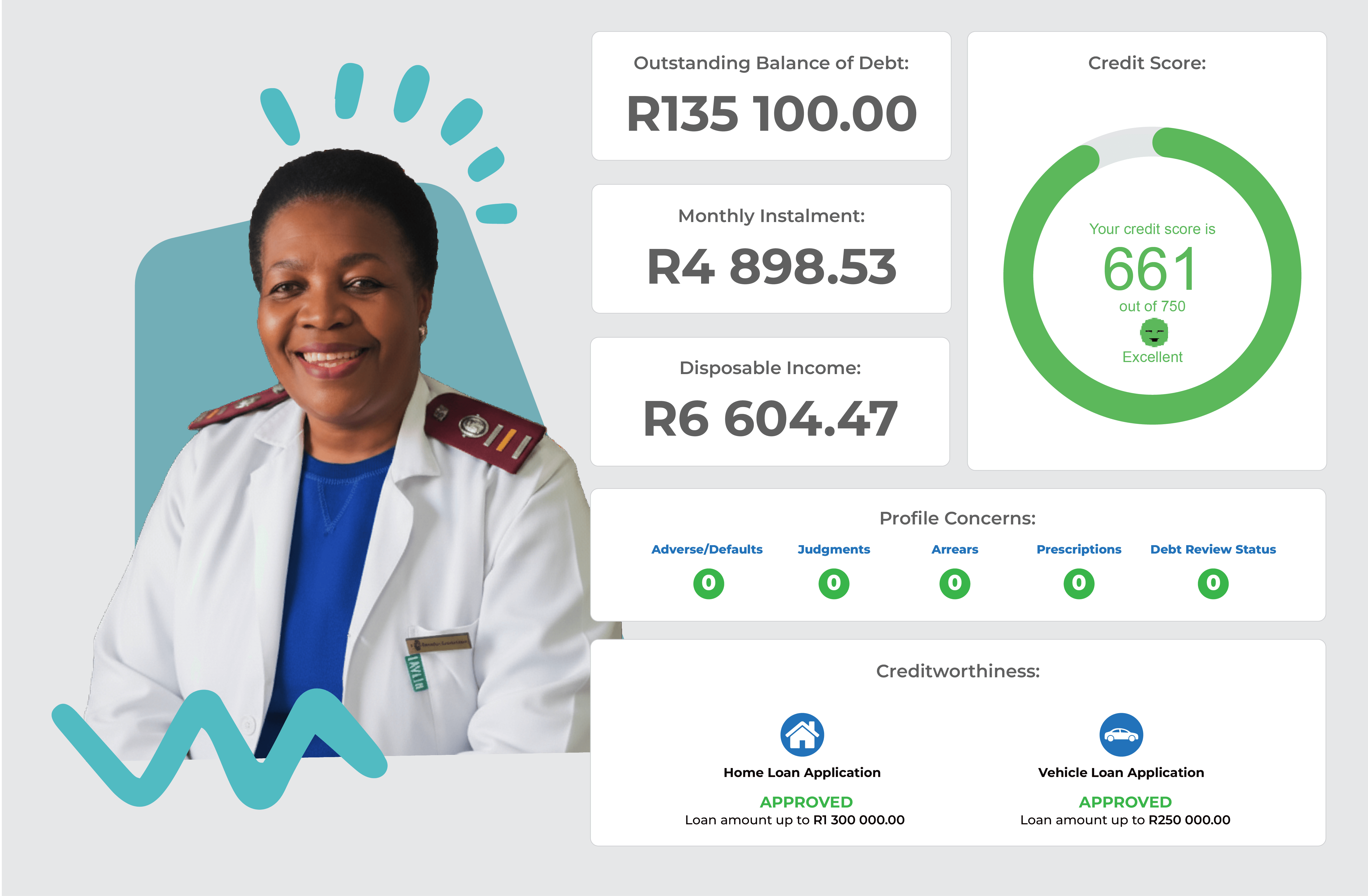

Behind on payments

Welltec

Welltec

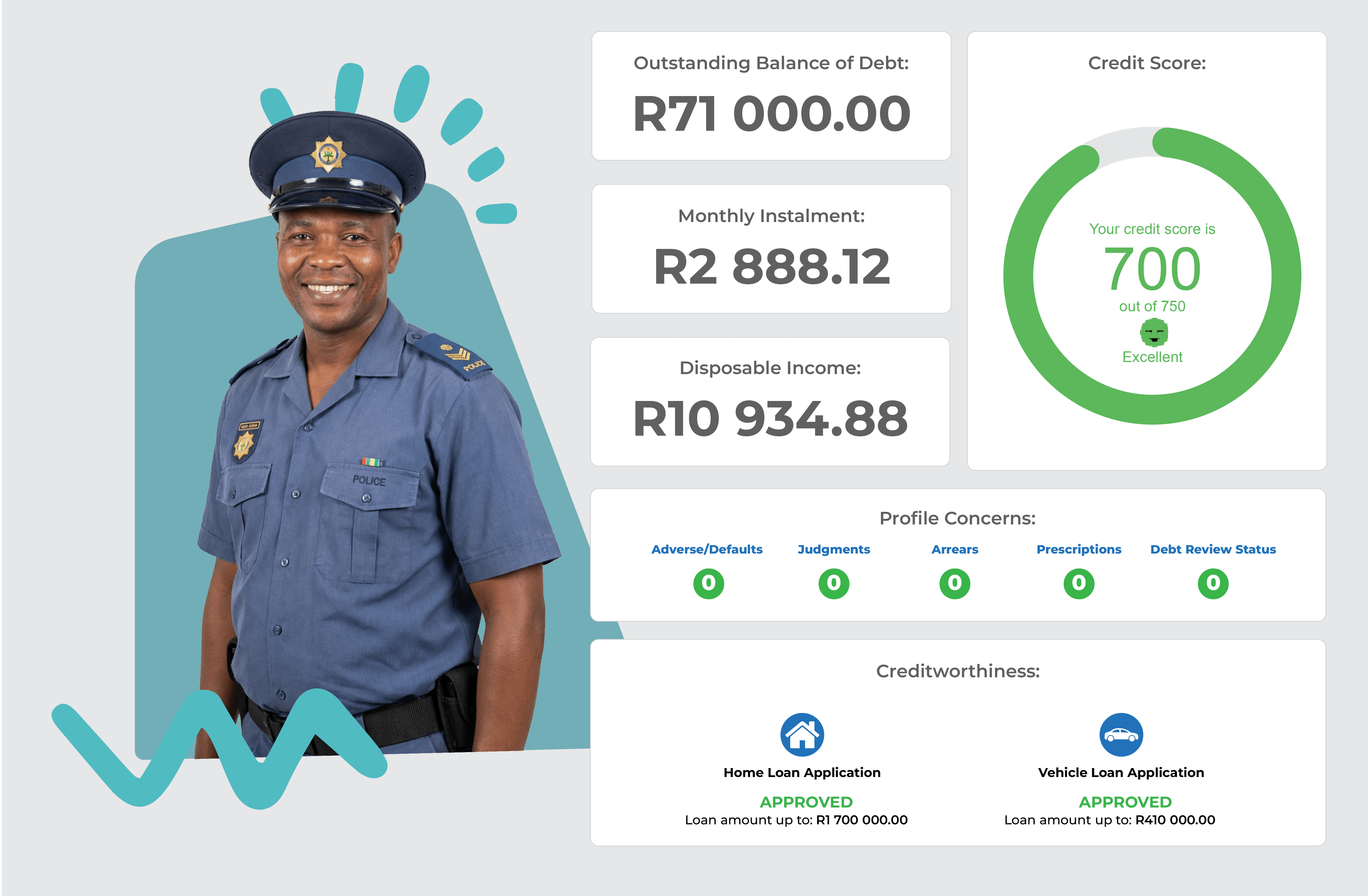

Start your journey with a Free Financial health assessment! The outcome of the assessment will determine the best possible solution to put you in a better financial position.

Consolidate Multiple debts into one lower instalment. We negotiate settlements directly with your creditors to secure the lowest possible settlement discount.

Learn moreRemove judgments, defaults, garnishee orders or withdraw from Debt Review.

Learn moreSafeguard your assets from repossession. We assist with Debt Review applications if your debt burden has become unmanageable.

Learn moreFree courses and tools on budgeting, saving and borrowing wisely.

Learn moreWe offer a range of insurance products designed to meet the diverse needs for you.

Learn more

My word, where do I start? I would like to give a big 5 star shout out to this company, they have lifted such a huge weight of my shoulders. They made me feel alive again, they made feel as if I have purpose again. Each and every consultant I dealt with called me on time, ensured what I applied for was done SOONER that I could have expected.

I never thought I would see the day that I will no longer be under Debt Review. I was under Debt Review for more than 10 years, unable to apply for a vehicle loan as I desperately needed my own transportation. I was assisted by a friendly team that kept me up to date throughout the process! Thank you Welltec for helping me get my financial freedom back.

At first I was extremely embarrassed about my personal financial situation, and was a bit scared to apply, but the Welltec team is very understanding, and they are so patient they know how to explain everything in detail. Good communication. Thank you Welltec for making my financial journey so easy.

My word, where do I start? I would like to give a big 5 star shout out to this company, they have lifted such a huge weight of my shoulders. They made me feel alive again, they made feel as if I have purpose again. Each and every consultant I dealt with called me on time, ensured what I applied for was done SOONER that I could have expected.

I never thought I would see the day that I will no longer be under Debt Review. I was under Debt Review for more than 10 years, unable to apply for a vehicle loan as I desperately needed my own transportation. I was assisted by a friendly team that kept me up to date throughout the process! Thank you Welltec for helping me get my financial freedom back.

At first I was extremely embarrassed about my personal financial situation, and was a bit scared to apply, but the Welltec team is very understanding, and they are so patient they know how to explain everything in detail. Good communication. Thank you Welltec for making my financial journey so easy.

Anyone can register on our platform to gain access to their free credit score, Free Financial Health Assessment and financial literacy courses, but should you need to apply for one of our financial products and services, your employer has to be partnered with Welltec. Our employer partners include:

No, checking your credit report on the platform will not affect your credit score.

There are two types of credit checks: hard checks and soft checks. Hard checks are performed by credit providers when you apply for credit, and they can impact your score as they leave a record on your credit profile.

Soft checks, on the other hand, are when you check your own credit report for personal use. These do not leave an enquiry on your profile and have no effect on your score. The credit check done through the platform is a soft check, meaning it’s completely safe and will not impact your credit rating.

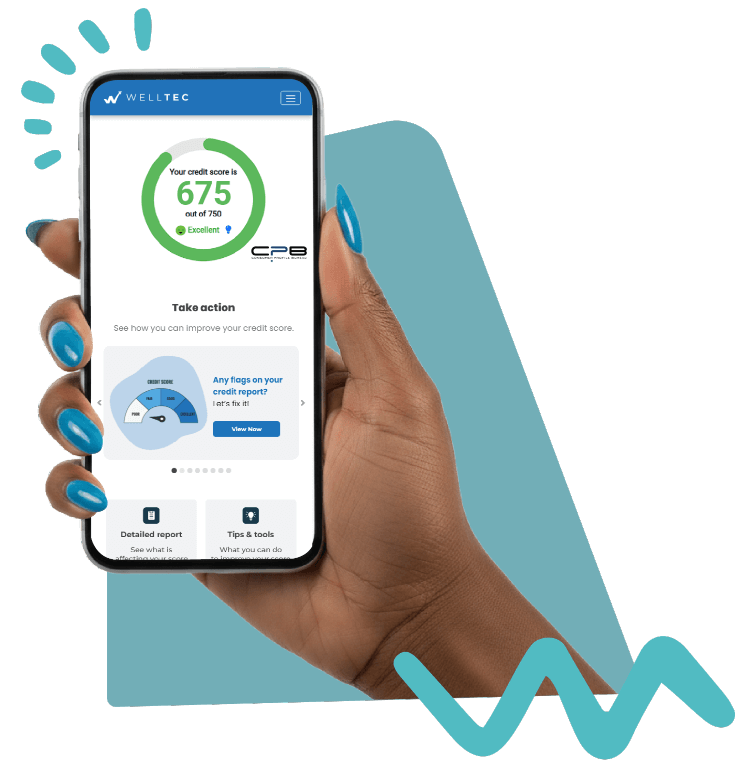

As part of our solution, we provide you with an in-depth comprehensive view of your personal financial situation. This includes an overview of your credit score and report and your debt history. When registering on the platform, we retrieve your credit information from a credit bureau to show you this picture on your dashboard. For that, we will need your ID number.

Our financial wellness solution is specifically designed to help over-indebted employees. We don’t base our decision solely on your credit score because the purpose of the rehabilitation loan is to help settle your outstanding debt and improve your credit record. However, to manage our risk as a responsible credit provider and ensure affordability, loan instalments are deducted directly from your salary. This method ensures consistent repayment and allows us to offer assistance where others might not.

No. The instalment for your rehabilitation loan and a garnishee order is not the same thing. A garnishee order is a court-ordered deduction from an employee's salary to pay off a debt, while loan instalment payroll deduction is a voluntary arrangement for repaying a loan directly from one's salary.

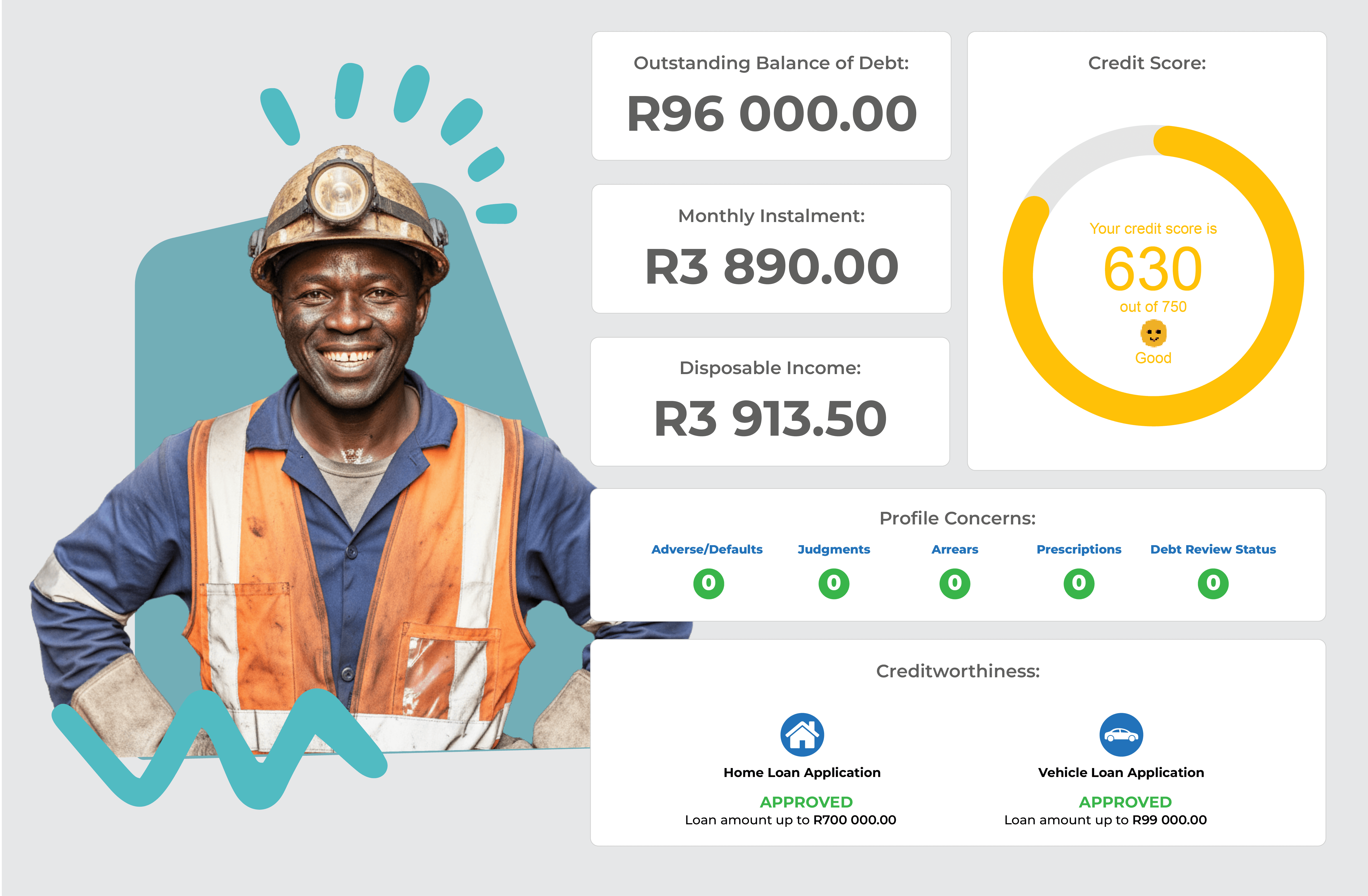

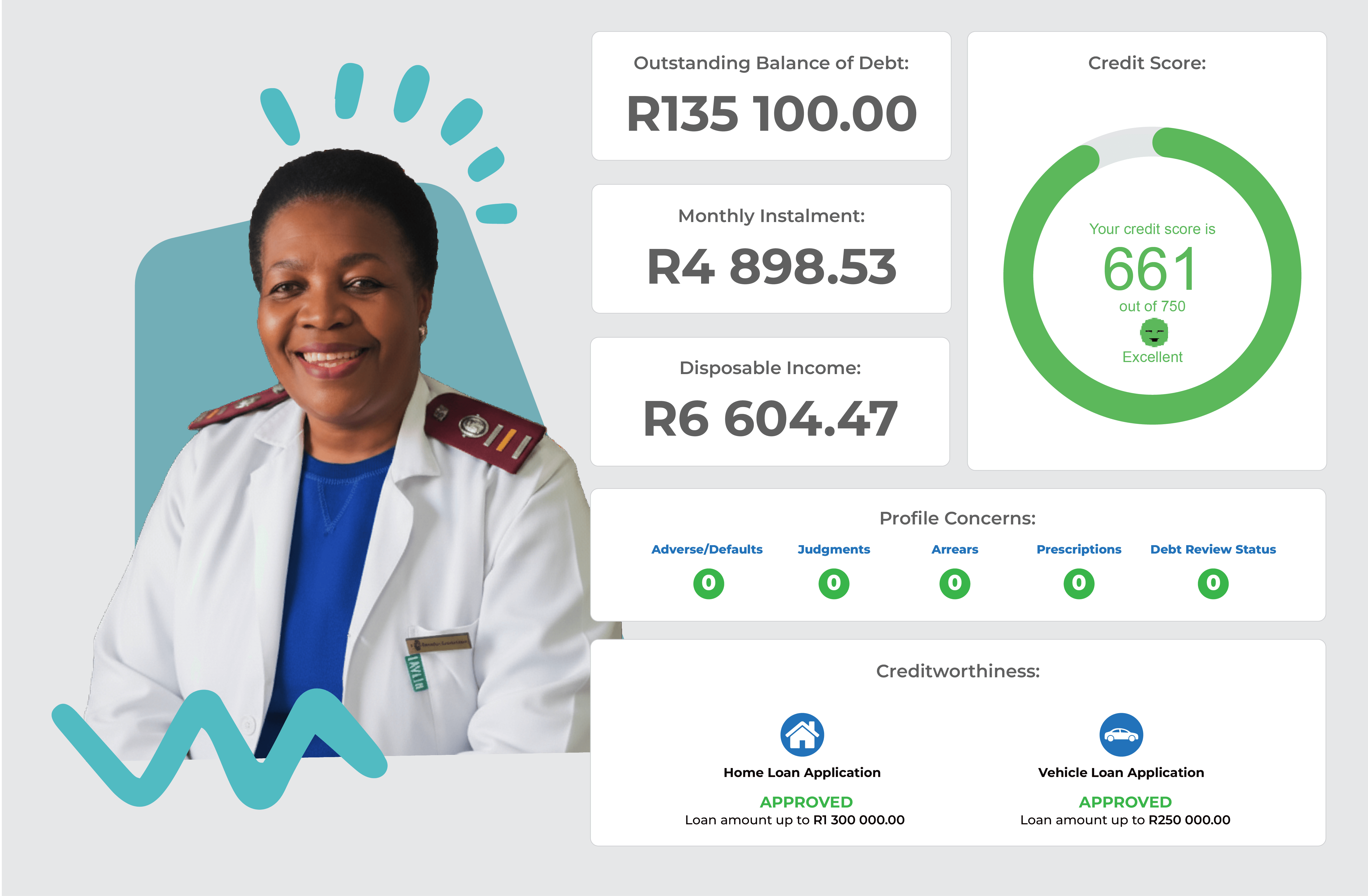

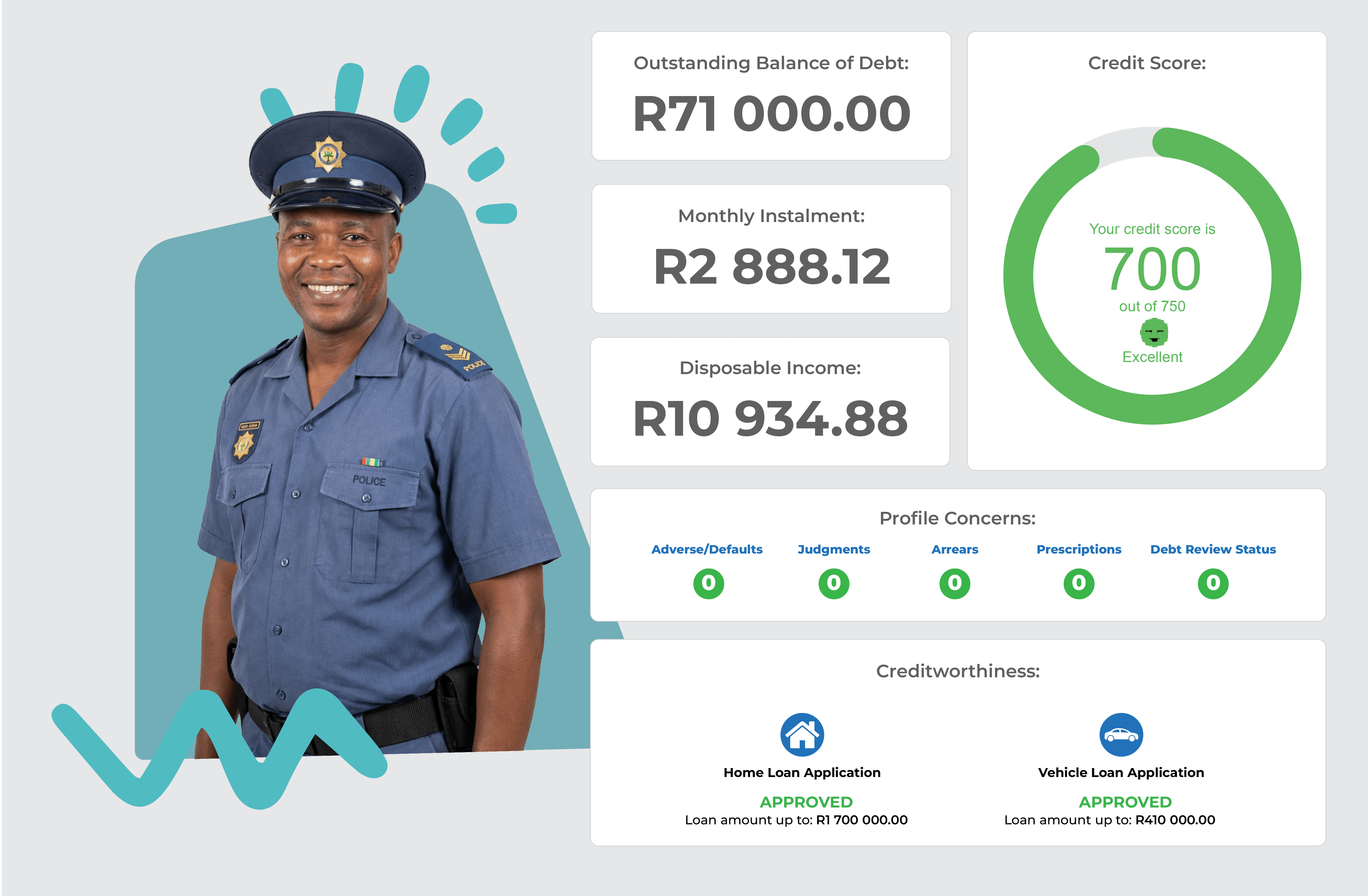

Each credit bureau uses its own scoring model and criteria to calculate your credit score. This means your score can vary depending on which bureau you check. For example, you might have a score of 500 at CPB and 450 at XDS—not because your credit history is different, but because each bureau has its own method, score bands, and data sources.

This is a free assessment we offer to give you an overview of your current financial situation, provide you with solutions on how to improve it, and give you an idea of what your financial situation could look like.

No, you won’t be required to pay any upfront fees. All costs associated with the rehabilitation loan—including any fees for removing or withdrawing negative listings from your credit report—are included in the total loan amount. This means you can access the assistance you need without having to make any payments upfront.

It is also important to remember that a Welltec agent wil never ask you to pay money into a company account before you are assisted with a product or a query.

No, the new loan will not be the same amount as your original debt. As part of the rehabilitation process, we negotiate favourable discounts with your credit providers, which reduces the outstanding balance. This means the new loan amount will be lower than your original debt.

There are multiple ways you can submit your documentation: