Millions of working South Africans are trapped in debt stress.

credit-active consumers are over-indebted

adults face financial stress

of net income is used to servicing debt

credit-active consumers are over-indebted

credit-active consumers are over-indebted

Financial stress doesn’t stay at home – it comes to work.

Employee over-indebtedness leads to:

Increased absenteeism and presenteeism

Higher staff turnover and recruitment costs

Workplace theft and fraud risk

Decreased productivity and quality of work

Safety concerns and accidents

Strained team dynamics and morale

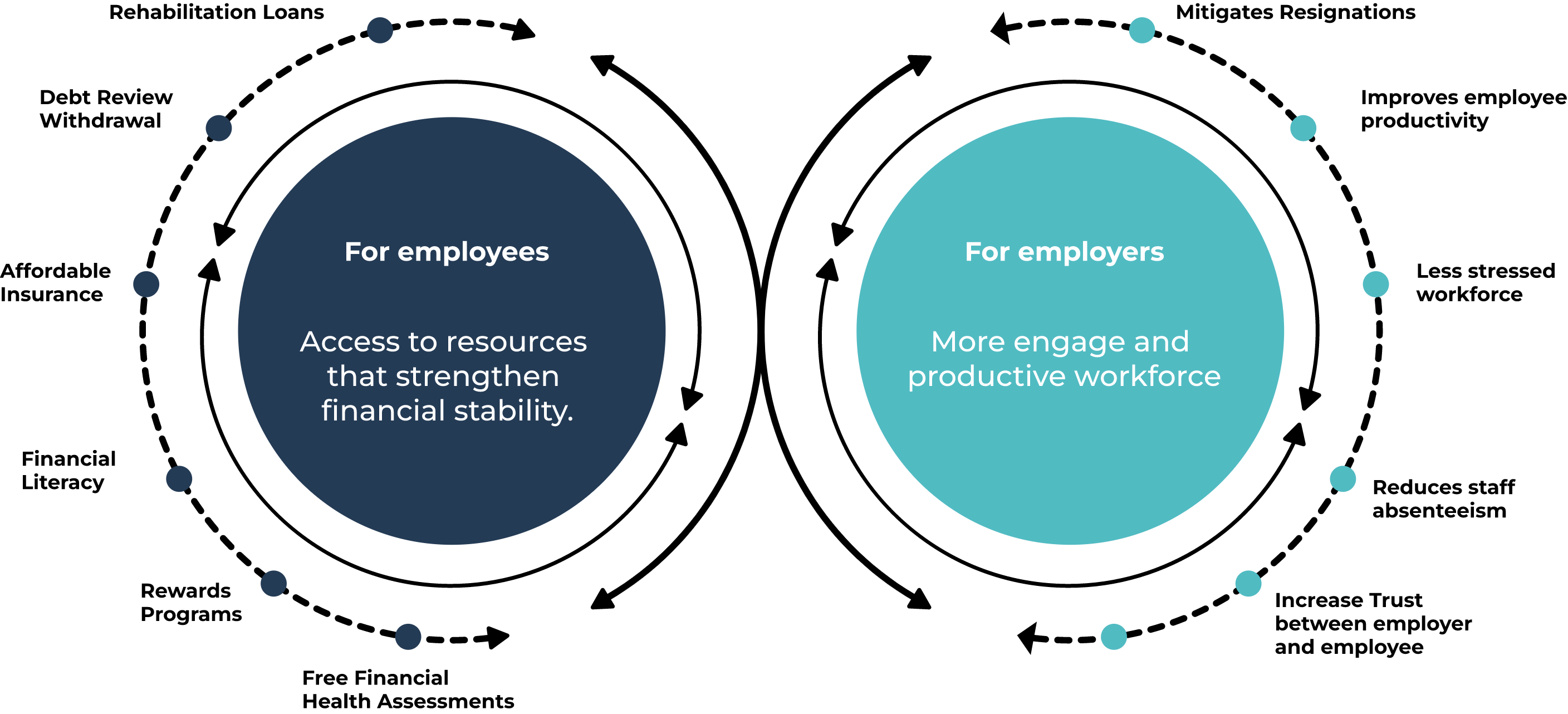

With zero cost or administrative burden to your business, you can give your employees confidential access to trusted financial wellness, rehabilitation support, and comprehensive financial wellness resources — empowering them to tackle debt challenges and regain financial stability:

Welltec is dedicated to offering employers a robust financial wellness program and debt solution designed to assist their employees with their debt-related challenges. Our solution is offered at no cost to you as the employer and is entirely free to implement.

Sign a payroll deduction and POPIA agreement with Welltec. This unlocks preferential benefits for your employees.

We conduct a due diligence assessment on your company, and require a few documents for this process. Our team handles setup, including creating your employer profile on our financial wellness platform.

Choose from multiple roll-out options: digital toolkits for your intranet, printed collateral, on-site consultations with staff or virtual Teams introductions and sessions.

We provide continuous financial wellness communication, regular reporting on the impact of the solution and dedicated corporate consultants available across all 9 Provinces.

Schedule a consultation with our corporate team.

Enter your details in the form and we will call you back.